“Sars will remove drop boxes for the submission of income tax returns and other paper documents.

“As of 1 July 2018, Sars will also no longer provide certain printed forms at its branches, including forms used to register as a taxpayer, as a VAT vendor, as an employer, as well as forms used to apply for tax directives,” said the revenue collection service.

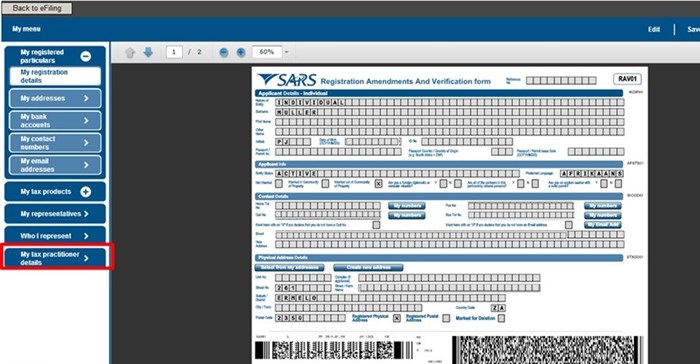

The transactions, together with the filing of income tax returns, payments and the uploading of supporting documents, can all be done electronically on eFiling with the support of Help-You-eFile and the contact centre if taxpayers get stuck.

“The increase in digital transactions means a significant saving on paper, printing and courier costs for both Sars and the taxpayer. This will also reduce traffic in branches – one of Sars’ objectives for tax season 2018,” said the service.

A digital and paperless approach was initiated more than a decade ago when the internet-based eFiling system was made available for the electronic submission of personal income tax returns.

Drop boxes were, however, provided in addition to the branch and electronic channels for taxpayers who chose to submit their returns and documents manually.

To accommodate larger files on its eFiling system, Sars has increased the size threshold of files from 2MB to 5MB.

The revenue service has assured taxpayers switching to eFiling that they will receive support.

“Taxpayers will still be able to visit a Sars branch if they need an assisted filing experience. However, they are encouraged to migrate to electronic submission. Original paper documents will be handed back to the taxpayer for safekeeping,” said Sars.

Sars encouraged taxpayers to use the 24-hour eFiling service at www.sarsefiling.co.za, which is the most convenient method for the majority of transactions with Sars.

There are also email addresses available on the website for taxpayers to interact with Sars, as well as the contact centre at 0800 00 7277.

SAnews.gov.za is a South African government news service, published by the Government Communication and Information System (GCIS). SAnews.gov.za (formerly BuaNews) was established to provide quick and easy access to articles and feature stories aimed at keeping the public informed about the implementation of government mandates.

Go to: http://www.sanews.gov.za