Several factors in the operating environment were noted:

• In September, both the manufacturing output Purchasing Managers Index or PMI (49.7) and new export orders PMI (47.7) saw a slight improvement to the previous month. They remained, however, below the critical 50-point threshold, indicating a continuing, but slightly slower, annual decline in global manufacturing production and exports.

• Global cross-border trade contracted for the fifth month in a row in August, decreasing 3.8% year-over-year. This reflects the cooling global macroeconomic environment.

• Annual growth in US consumer prices stabilized in September at 3.7%, the same rate as in August. In Europe and Japan, consumer price inflation slowed by 1.0 and 0.2 percentage points, respectively, to 4.9% and 3.0%, (also respectively). In China, deflation-fighting policy measures saw an annual rise in consumer prices of 0.1%.

• In September, the average price of jet fuel was USD 131.0 per barrel, marking a 43.1% increase from the May 2023 price. Recouping some of this added cost from surcharges in September contributed to the first increase in air cargo yields since November 2022.

"Air cargo eked out modest growth (1.9%) in September despite falling trade volumes and high jet fuel prices. That clearly shows the strength of air cargo’s value proposition. With the key export order and manufacturing PMIs hovering near positive territory, we can be cautiously optimistic for a strong year-end peak season," said Willie Walsh, Iata's director general.

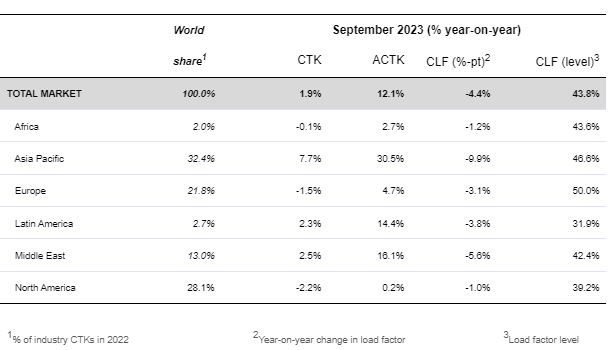

African airlines saw their air cargo volumes decline by 0.1% in September 2023, despite the strong growth of demand on the Africa-Asia trade lane (+12.8%). This was an improvement in performance compared to August (-3.5%). Capacity was 2.7% above September 2022 levels.

Asia-Pacific airlines saw their air cargo volumes increase by 7.7% in September 2023 compared to the same month in 2022. This was a significant improvement in performance compared to August (+4.6%).

Carriers in the region benefited from growth on three major trade lanes: Europe-Asia (+9.6%), Middle East-Asia (+7.0%) and Africa-Asia (+12.8%). Available capacity for the region’s airlines increased by 30.5% compared to September 2022 as more belly capacity came online from the passenger side of the business (a year ago, the key Asian markets of Japan and China were still largely under severe Covid-19 travel restrictions).

North American carriers had the weakest performance in September, with a 2.2% decrease in cargo volumes. This was a decline in performance compared to August (-1.4%).

Although contractions in the North America-Asia trade lane narrowed (from -4.3% in August to -1.8% in September), the North America-Europe market stabilised its decline at (-2.5%) for the second month in a row. Carriers in the region did not benefit significantly. Capacity increased moderately by 0.2% compared to September 2022.

European carriers saw their air cargo volumes decline by 1.5% in September compared to the same month in 2022. This was a weaker performance than in August (-0.6%). Carriers in the region suffered from further contractions in the Europe market (-5.7% in September vs -5.2% in August).

Gains made from the expansion in the Middle East-Europe trade lane (+3.3% in September vs +0.5% in August) offset some declines from the within-Europe performance. Capacity increased by 4.7% in September 2023 compared to 2022.

Middle Eastern carriers had the strongest performance in September 2023, with a 2.5% year-on-year increase in cargo volumes. This was an improvement from the previous month’s performance (+1.3%).

Carriers in the region benefited from growth in the Middle East–Asia (+7.0%) and Middle East–Europe markets (+3.3%). Capacity increased by 16.1% compared to September 2022.

Latin American carriers experienced a 2.3% increase in cargo volumes compared to September 2022. This was a significant decrease in performance compared to the previous month (+6.2%). Capacity in September was up 14.4% compared to the same month in 2022.