Marketing & Media trends

Industry trends

BizTrends Sponsors

Trending

Jobs

- Marketing Manager Johannesburg

#BizTrends2020: Radio's rocky but rising road

My default setting is always set to “optimist”, but I do think it will be the brands and leaders with steady hands and a medium-term outlook that will emerge on the right side of the upturn when it comes – and it will come, eventually.

I am seeing a lot of panic by media owners across a range of formats, and I think it is likely that the next 12 months will be characterised by some (more) shareholder churn on key brands.Whilst the short-term outlook for radio is likely negative (I predict the medium will close flat - 2% down year-on-year between now and June next year), prospects will be aided by the following aspects – some in and some out of our control:

1. Radio must overcome its image problem

Radio is a great person, she just dresses badly. Radio delivers audiences, and most importantly for its clients, it delivers actions.

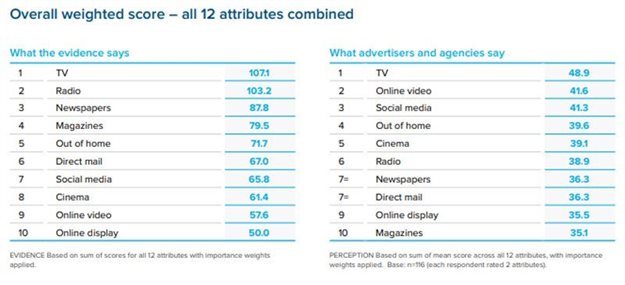

In a 2018 study in the UK (Ebiquity’s “Re-evaluating Media”), marketers were asked to list the most important attributes to building a brand over time, and to provide their opinion of each medium’s efficacy.

This was then tested against actual performance scores per medium. The overall results showed that radio was far more effective than it was given credit for.

This is a recurring theme, and a by-product of the tendency for the industry and associated publicity to actively laud the “shiny and new” over the “solid and reliable”.

More South African-based studies will emerge this coming year to further our understanding of radio’s efficacy and debunk a few more myths.

In 2019, the inaugural ’The Infinite Dial South Africa’ demonstrated two things – firstly, that the industry can get together and commission insightful material that benefits the industry (and others), and, secondly, that FM radio dominates audio consumption here, and will for some time. Claims by streaming and podcast stand-alones that they have critical mass are simply nonsense.

The wonderful thing about ‘The Infinite Dial’ coming to SA (thanks to the National Association of Broadcasters) is that the podcast and streaming space will now have the data to underpin its business plans, and the rate of growth of these formats will no doubt be high from one survey to the next.

We just need to allocate them realistically to “complementary” mediums and traditional distribution methods, until data access fundamentally changes the paradigm.

2. Regulators and policy-makers cannot continue to avoid the “C word”

Radio is a strong but mature industry in South Africa, and whilst audience prospects are more than healthy for a long time to come, available media options to advertisers are growing exponentially. It’s a textbook case of an industry in a low-growth stage of its life cycle, and the text-books all say consolidate, consolidate, consolidate!

Surely, I don’t need to list the examples? The SABC unable to make a profit out of even some of its commercial brands; Classic FM with its significant reach across the lucrative Johannesburg geography going into business rescue; community stations (who actively seek advertising) failing to earn enough to keep the transmitters on; mounting debt within otherwise popular radio brands in primary markets…

The ‘gold-rush’ of radio in the 90s was heavily regulated, and, in the main, appropriately so, to promote sustainability and diversity of ownership from a broad spectrum of South Africans. It’s time to recognise that the players who have been part of the construction of this vibrant industry are the ones with the means to sustain it in this new and tougher environment. They must be able to grow their portfolios to justify continued investment via scale, and operators with smaller portfolios need the opportunity to exit, knowing their brands will be part of a credible stable.As long as ownership is restricted to two FM licences per operator, there will be no economies of scale. Less free cash available to invest into the business will stymie innovation, and ultimately the niche brands that add variety to smaller population groups (like Classic FM) will simply fall off the dial.

I know that the need for relaxing ownership restrictions has dawned, or is dawning, on key people with the means to change things. But it will take resolve and no doubt some political courage to act and enable us to contribute more to the radio industry, and South African audiences, in the future.

3. Stick to the fundamentals, don’t be distracted

It’s tempting in a difficult economy to cut back on research and marketing. I have encountered many radio managers who disagree with me, but these – plus talent – are the three foundation stones of sustainable radio brands.

We have arguably the most diverse and “socially complex” listening market in the world. All our varied demographic groupings have historical, geographic, generational, and other factors influencing their consumption habits and outlooks.

It can be baffling to media experts from other territories. What it means is that “gut feel” might carry a brand forward to a point (usually within a targeted niche market), but research will be the only way to uncover how a radio brand can succeed at scale.

I said it in an earlier article last year and will continue to claim that music research and regular market studies are “fixed” rather than “discretionary costs to a serious radio manager”.

Innovate, disrupt, and test your gut on the fringes of your core product by all means, but the stakes are too high in breakfast and during the day for a few to intuit what many listeners are after.

When the product is good, market it clear and bold – radio is showbusiness – and listeners (and advertisers) need to be consistently reminded of how much value it adds to people’s lives every single day.

In closing, I was fortunate recently to attend a study trip with other European and African broadcasters to the United States to get a sense of how the market there is evolving. Those learnings are perhaps the subject of another article, but they left me with an overwhelming sense that the industry has a bright future.

The US market is characterised by increasing sophistication in the advertising tech side to offer audience segments at scale to clients, and interesting work in attribution of consumer actions to individual radio ads.

Podcasting is coming of age, but very much a “reach” medium, garnering over 200k downloads in a week for a relatively good podcast episode.

Pure-play streaming providers are also galloping up the growth graphs. It means we will have to increasingly think of radio as “audio” and continue to stay at the forefront of these opportunities as they gain momentum.

We will not be immune to disruption but currently it’s the radio players who are making the biggest inroads into podcast audio locally, and this must not be taken for granted (or go unrecognised).

Notwithstanding the revenue challenges across the board, for Kagiso Media brands, 2019 has been a knockout year from an audience engagement perspective – for the first time in my career I have seen two radio stations exceed in monthly UBs (to their websites) the total weekly cume audience (Jacaranda and East Coast Radio).

Plus, both our breakfast shows won awards and grew audiences in the year. My heartfelt thank you to our amazing teams, their success is very richly deserved…

Hindsight is not only 2020. For this brief moment in history, foresight is 2020 also. I’m sure it will be a challenging, but good one!

*Click here to download ‘Infinite Dial South Africa 2019’ and here to download Ebiquity’s ‘Re-evaluating Media’.