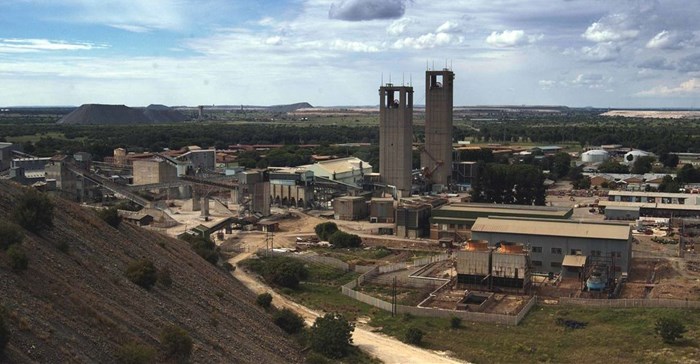

Harmony will buy the operational Moab Khotsong mine and its shuttered neighbour, the Great Noligwa mine, as well as gold-bearing tailings and the Nufcor uranium plant.

Investors present at the shareholder meeting on Thursday voted 99% in favour of the transaction.

Harmony CEO Peter Steenkamp has said there will be a 62% increase in free cash flow from SA, with the 250,000 ounces-a-year Moab Khotsong mine becoming Harmony's most profitable mine.

The roughly R4bn purchase price of the transaction is just under half the R9.2bn market capitalisation of Harmony, which has mines in SA and Papua New Guinea.

Of the $300m, Harmony will fund $200m through its own financial resources of cash and debt facilities, and the remaining $100m through a rights issue, down from the $200m it had originally planned.

For more than two decades, I-Net Bridge has been one of South Africa’s preferred electronic providers of innovative solutions, data of the highest calibre, reliable platforms and excellent supporting systems. Our products include workstations, web applications and data feeds packaged with in-depth news and powerful analytical tools empowering clients to make meaningful decisions.

We pride ourselves on our wide variety of in-house skills, encompassing multiple platforms and applications. These skills enable us to not only function as a first class facility, but also design, implement and support all our client needs at a level that confirms I-Net Bridge a leader in its field.

Go to: http://www.inet.co.za