Insight Survey’s latest SA Fast Food/QSR Landscape Report 2021, carefully unfolds the global and local fast food/QSR markets (including the impact of Covid-19), based on the most credible intelligence and research. It examines the relevant global and local market trends, innovation and technology, drivers and challenges, to present an objective insight into the South African fast food industry environment and its future.

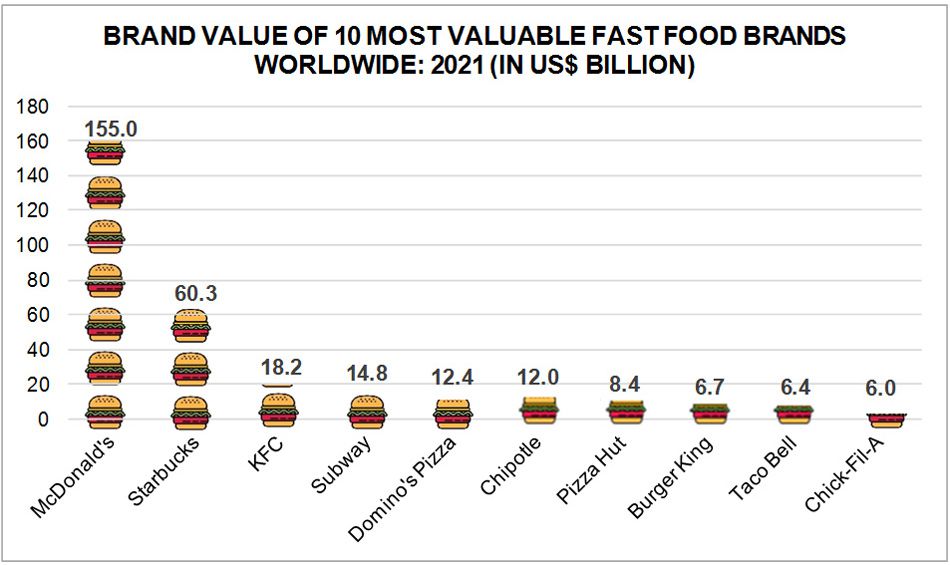

Globally, the fast food market is valued at approximately US$648 billion in 2021, and is forecast to grow at a compound annual growth rate (CAGR) of 4.6%, to reach approximately US$932 billion in 2026. As illustrated in the graph below, McDonald’s remains the most valuable fast food brand in 2021 by a large margin, achieving a value of US$155.0 billion. Interestingly, Tim Hortons fell out of the top 10 in 2021, being replaced by Chick-Fil-A, with a brand value of US$6.0 billion.

Source: Kantar; Graphics by Insight Survey In 2020, the Covid-19 pandemic hit the South African fast food industry exceptionally hard, reflected in the fact that the market contracted by a massive 27.2% between 2019 and 2020. However, positively, the local market is expected to recover and grow at a CAGR of 4.5%, between 2021 and 2025. This growth is expected to be driven by the expansion of contactless services, economic recovery, as well as a normalisation to a post-pandemic world.

In South Africa, the spend on online food delivery has experienced significant growth amid the Covid-19 pandemic, almost doubling in value between 2019 and 2020. In particular, according to the latest FNB data, the Uber app remains the most used delivery app, whilst Mr D Food recorded the largest increase in usage (140%) since the start of the lockdown.

Furthermore, a variety of innovative food ordering and delivery service apps have been introduced and expanded locally. This includes Pekkish SA, a new local food market app connecting Cape Town residents to home kitchen businesses in the city, that also aims to make these kitchens accessible to outlying areas not covered by traditional delivery service providers.

MyChef is another new food delivery app that aims to create a platform for smaller restaurants, charging a significantly lower commission fee, when compared to the Uber Eats and Mr D Food platforms. Additionally, Mr Yum is a food ordering platform that incorporates QR code mobile table-ordering, enabling access to web-based digital menus through which they can order and pay, without having to download additional apps.

Moreover, a new food delivery service, Dryvar Foods, has officially launched its cloud-based delivery application. The company aims to "power all local restaurants, grocery stores and on-the-go food outlets using customised artificial intelligence and route tracking capability". Its food delivery app is powered by Amazon’s artificial intelligence and marketing machine learning software, which Dryvar Foods has customised to its service offering.

In terms of traditional in-dining players, the Spur Corporation has made its intentions clear and is rapidly becoming a serious fast food market competitor. In particular, Spur Steak Ranches has recently opened its very first drive-thru location in Pretoria, with plans to introduce drive-thru formats for its RocoMamas and Bento brands.

Interestingly, the prominent trend of 2020 that was previously reported by Insight Survey, ghost kitchens, continues to gain traction in the local market, with an increasing number of local players emerging, including Oishi Sushi, Fast Food Network, and Hot Kitchen, amongst others. Established players, such as Spur Corporation, are also capitalising on this trend with the introduction of more than seven ghost (virtual) kitchen brands in 2020, e.g. Pizza Pug, Bento and RibShack Rocofellas, with the burger and pizza categories generating the highest sales amongst these brands.

The South African Fast Food/QSR Industry Landscape Report 2021 (166 pages) provides a dynamic synthesis of industry research, examining the local and global fast food industry (including the impact of Covid-19) from a uniquely holistic perspective, with detailed insights into the entire value chain – market size and forecasts, latest industry trends and innovation, industry drivers and challenges, fast food/QSR competitor analysis, latest marketing and advertising news, pricing and promotion analysis.

Some key questions the report will help you to answer:

- What are the current market dynamics of the global and South African fast food industry?

- What are the latest global and South African fast food industry trends, innovation and technology, drivers, and challenges?

- What are the market, food-type and off-line/on-line value trends in the South African fast food market (2015-2020) and forecasts (2021-2025), including the impact of Covid-19?

- Who are the key South African fast food market players and what is the latest marketing and advertising news for each of the competitors?

- What is the pricing and recent promotions of key fast food competitors by category: Burgers, Chicken, Pizza, Pies, and Others?

Please note that the report is available for purchase. For more details and a full brochure, click here: South African Fast Food/QSR Industry Report 2021.

For more information, please email az.oc.yevrusthgisni@ofni or call our Cape Town office on (021) 045-0202 or Johannesburg office on (010) 140- 5756.

About Insight Survey:

Insight Survey is a South African B2B market research company with more than 15 years of heritage, focusing on business-to-business (B2B) and industry research to ensure smarter, more-profitable business decisions are made with reduced investment risk.

We offer B2B and industry research solutions to help you to successfully improve or expand your business, enter new markets, launch new products or better understand your internal or external environment.

Our bespoke Competitive Business Intelligence Research can help give you the edge in a global marketplace, empowering your business to overcome industry challenges quickly and effectively, and enabling you to realise your potential and achieve your vision.

From strategic overviews of your business’s competitive environment through to specific competitor profiles, our customised Competitive Intelligence Research is designed to meet your unique needs.

For more information, go to www.insightsurvey.co.za.